‘I’m really worried’: homeowners and would-be buyers on UK interest rates

As the base rate reaches 4%, we hear from people concerned about rising mortgage costs Chris Felix-Hill, 47, and his wife, Adeline, from Steeple, Essex, are struggling to keep alive their dream of one day becoming homeowners, after “demoralising” house price rises during the pandemic and yet another interest rate rise from the Bank of […]

Will the interest rate rise trigger a stampede for tracker mortgages?

Hints by Bank of England that rates may have peaked leaves those remortgaging in a quandary What does the Bank of England interest rate rise mean for you? The rush towards tracker mortgages that began even before Thursday’s interest rate rise could well become a stampede after the Bank of England signalled that rates may […]

Bank of England raises UK interest rates to 4%

Hike of 0.5 percentage points lifts rates to 14-year high, but BoE says shorter and shallower recession now more likely Interest rates rise again but Bank of England hints at a brighter future The Bank of England raised interest rates for a tenth consecutive time on Thursday from 3.5% to 4%, but said inflation may […]

UK borrowers may struggle to repay debt as economy worsens, says Santander

Bank puts aside more money to protect itself from potential defaults in expected recession The impending recession could leave borrowers struggling to repay their debts, the high street bank Santander UK has said as it put aside more cash to protect itself from potential defaults. The UK arm of the Spanish bank said on Thursday […]

UK demand for mortgages slumps as interest rates deter buyers

Bank of England figures also reveal many households are dipping into savings, rather than using credit cards Demand for mortgages has collapsed to its lowest level since the depths of the 2020 lockdown as potential homebuyers are deterred by rising interest rates, the latest official figures show. The Bank of England said the number of […]

UK’s LendInvest Acquires Funding from Lloyds Bank to Launch into Homeowner Mortgages

LendInvest (LSE: LINV), which claims to be the UK’s leading asset manager for property finance, announces increased funding from Lloyds Bank now totaling £300 million “to support its entry into the UK’s £1.2 trillion homeowner mortgage market.” LendInvest’s home owner mortgage product, “which beta launched… Read More

Priced-out UK house-hunters turn to lorry-sized tiny homes

Trailer-like homes are attracting people struggling to buy or rent a house. Our writer went to size one up You might bump your head, and the wheels betray its caravan roots, but it’s yours – and that’s the key for a growing number of people fleeing the UK housing crisis in a “tiny home”. Factory-built, […]

UK Mortgage Payments Hit Highest Level Since 2008

Mortgage costs relative to income in the United Kingdom have risen to their highest level in years. The latest data published by mortgage lender Nationwide Building Society Friday (Jan. 13) revealed that in the final quarter of 2022, first-time buyers were spending on average 39% of their take-home pay on mortgage repayments, the highest level […]

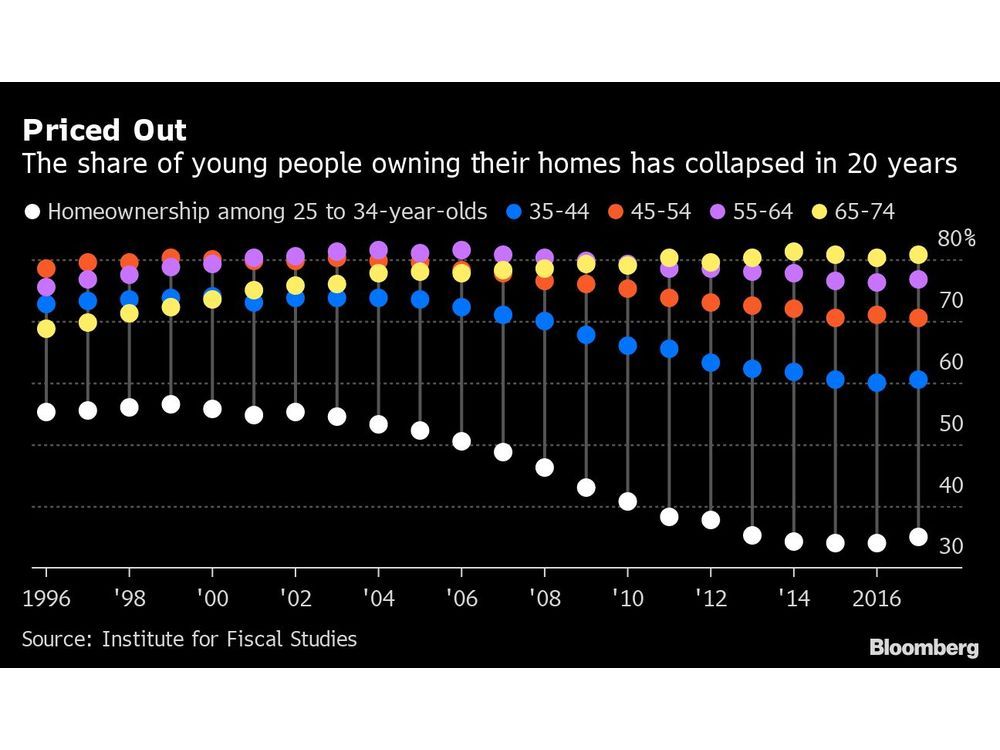

Britain’s Housing Market Is Flashing Red and Sunak’s Tories Are Scared

(Bloomberg) — Every Conservative leader in living memory has made the same basic promise to UK voters: work hard and you will earn more, buy a bigger house and one day pass it on to your children. Thirteen years after the party returned to power, some allies of Prime Minister Rishi Sunak fear the dream is dying. Read […]

Tell us: are you struggling with the process of buying a house in the UK?

We would like to hear from people trying to buy yet struggling to afford rising rents in the meantime, or those experiencing issues with getting mortgages approved As UK mortgage approvals have fallen to their lowest level since 2021, and as mortgage rates continue to rise, we would like to hear from people who are […]